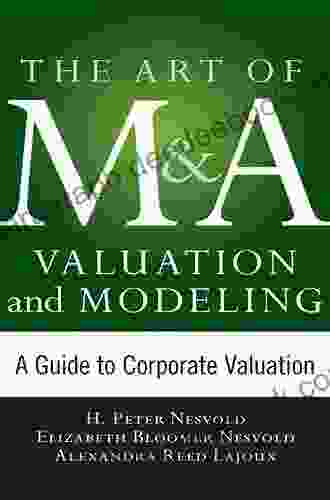

A Comprehensive Guide to Corporate Valuation: The Art of Determining Value

Corporate valuation is a critical aspect of various financial transactions, including mergers and acquisitions, private equity investments, and venture capital financing. It involves determining the fair market value of a company, which is essential for making informed investment decisions and negotiating deals. This comprehensive guide provides a thorough understanding of corporate valuation, its techniques, and the factors that influence a company's value.

4.4 out of 5

| Language | : | English |

| File size | : | 30050 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 403 pages |

Understanding Corporate Valuation

Corporate valuation is the process of determining the economic value of a company. It considers various factors, including the company's financial performance, industry dynamics, competitive landscape, and growth prospects. The primary objective of valuation is to estimate the price at which a willing buyer would purchase the company from a willing seller, assuming both parties are acting rationally and have access to all relevant information.

Valuation Methods

There are several methods used to value companies, each with its own strengths and limitations. The most common valuation methods include:

Discounted Cash Flow (DCF)

DCF is a method that involves forecasting the company's future cash flows and discounting them back to the present at a specified rate to determine its value. It is widely used in investment banking and private equity to value companies with predictable cash flows.

Comparable Company Analysis (CCA)

CCA compares the company being valued to similar companies that are publicly traded. The valuation is determined by multiplying the company's financial metrics, such as revenue or EBITDA, by the multiples of the comparable companies.

Precedent Transactions

This method involves analyzing recent mergers and acquisitions involving similar companies. The valuation is based on the transaction prices and the financial characteristics of the companies involved.

Factors Influencing Corporate Value

Numerous factors influence a company's value, including:

Financial Performance

Financial performance is a key indicator of a company's health and profitability. Factors such as revenue growth, profitability margins, and cash flow generation are heavily scrutinized by investors and analysts.

Industry and Competitive Landscape

The industry in which a company operates can significantly impact its value. Factors such as industry growth, competition intensity, and regulatory environment need to be considered.

Growth Prospects

The company's growth prospects are vital for determining its value. Investors are willing to pay a premium for companies with strong growth potential.

Management and Corporate Governance

The quality of management and the effectiveness of corporate governance practices can influence a company's value. Investors and lenders prefer companies with experienced management teams and sound corporate governance structures.

Risk Profile

The risks associated with a company's operations and industry can affect its value. Investors typically demand a higher return for companies with higher risk profiles.

Corporate valuation is a complex and challenging process that requires a thorough understanding of financial analysis, industry dynamics, and valuation techniques. By considering the factors outlined in this guide, investors and analysts can make more informed decisions and determine the fair value of companies. It is important to note that valuation is not an exact science, and the value of a company can vary depending on the specific context and assumptions used in the valuation process.

4.4 out of 5

| Language | : | English |

| File size | : | 30050 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 403 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Page

Page Chapter

Chapter Story

Story Genre

Genre Reader

Reader E-book

E-book Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Footnote

Footnote Manuscript

Manuscript Codex

Codex Tome

Tome Classics

Classics Memoir

Memoir Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Archives

Archives Study

Study Scholarly

Scholarly Lending

Lending Reserve

Reserve Reading Room

Reading Room Rare Books

Rare Books Special Collections

Special Collections Literacy

Literacy Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Awards

Awards Theory

Theory Textbooks

Textbooks Gill Hasson

Gill Hasson Didier Le Fur

Didier Le Fur John Feffer

John Feffer Dale Brown

Dale Brown William Joyce

William Joyce Enjoy Discovering

Enjoy Discovering David Fagan

David Fagan Jack Umstatter

Jack Umstatter Antony Wootten

Antony Wootten Mya Grey

Mya Grey Ariel Sacks

Ariel Sacks Charles Dudley Warner

Charles Dudley Warner Gloria J Miller

Gloria J Miller Steve Herman

Steve Herman Lesley Bown

Lesley Bown Maddy Court

Maddy Court Sarah Jane Stratford

Sarah Jane Stratford Edward C Chang

Edward C Chang Marisa Abrajano

Marisa Abrajano Ronald Lewis

Ronald Lewis

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Griffin MitchellTouring Journal of England and Ireland: An Immersive Travelogue Through...

Griffin MitchellTouring Journal of England and Ireland: An Immersive Travelogue Through... John MiltonFollow ·10.1k

John MiltonFollow ·10.1k Ivan TurnerFollow ·8.5k

Ivan TurnerFollow ·8.5k Chase SimmonsFollow ·15.9k

Chase SimmonsFollow ·15.9k Derek BellFollow ·18.5k

Derek BellFollow ·18.5k Alan TurnerFollow ·7.5k

Alan TurnerFollow ·7.5k Douglas PowellFollow ·17.2k

Douglas PowellFollow ·17.2k F. Scott FitzgeraldFollow ·9.8k

F. Scott FitzgeraldFollow ·9.8k David MitchellFollow ·5.4k

David MitchellFollow ·5.4k

Ricky Bell

Ricky BellThe Marriage: An Absolutely Jaw-Dropping Psychological...

In the realm of...

Ray Blair

Ray BlairDiscover the Enchanting Charm of Budapest and Its...

Nestled in the heart of...

Tyrone Powell

Tyrone PowellHuddle: How Women Unlock Their Collective Power

Huddle is a global movement that empowers...

Grayson Bell

Grayson BellThe Coin Story of the Holocaust: A Symbol of Hope and...

In the depths of the...

Virginia Woolf

Virginia WoolfFolklore Performance and Identity in Cuzco, Peru: A...

Nestled amidst...

Dylan Mitchell

Dylan MitchellThe Enduring Love Story of Héloïse and Abélard: A Tale of...

An Intellectual Passion In the heart of...

4.4 out of 5

| Language | : | English |

| File size | : | 30050 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 403 pages |